Our Acquisitions

$40,000,000+

Assets Under Management

Lincoln Trail MHP Portfolio

Acquisition Price: $13,000,000 | Equity Multiple: 3.0x / 5 Years

Closed: December 9, 2025

-

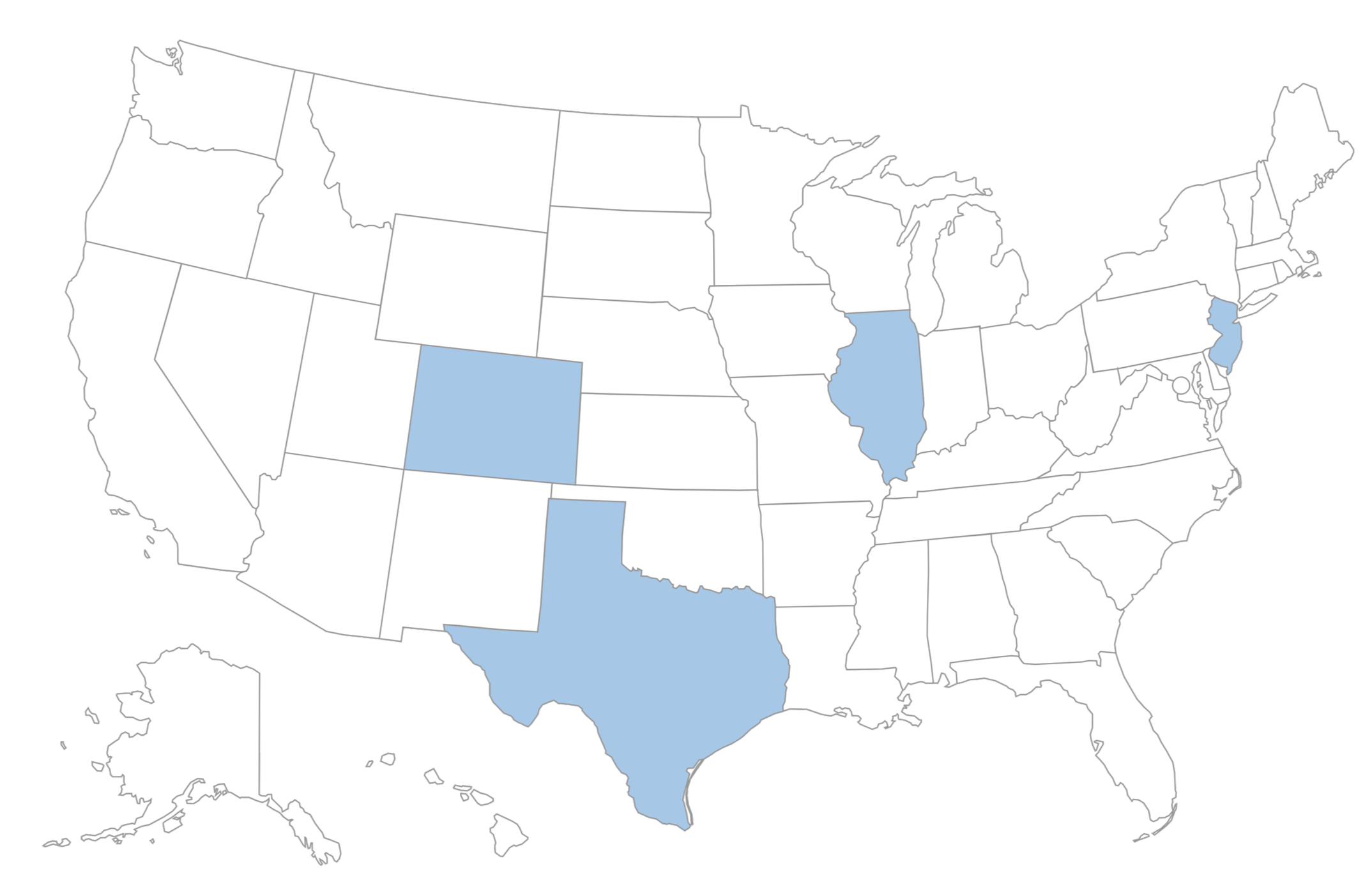

Lincoln Trail is a large-scale mobile home park portfolio located within Springfield, IL, comprising of 853 pads across five manufactured housing communities. The portfolio was acquired following years of management neglect and presented clear value-add opportunities. The portfolio, acquired at a low basis, allowed Hukam Capital Group to gain meaningful exposure to the manufactured housing asset class.

-

The portfolio presented a significant portion of vacant homes to be renovated and brought back online. With comparable major communities reaching 95% occupancy, this highlighted the upside to be achieved through strategical capital deployment and professional property management. With the asset class continued to be characterized by high tenant stickiness, strong long-term fundamentals, and restrictive zoning, the property was positioned as compelling value-add opportunity.

-

Hukam Capital Group has co-invested alongside MHCI Group, a vertically integrated mobile home park operator with over 1,100 pads under management. The value-add plan focuses on renovating and occupying vacant homes, improving operations and realizing cost synergies across the portfolio. This operation strategy targets strong cash flow generation, accelerated depreciation, and a refinance to return capital to investors and maintaining exposure within a high-quality manufactured housing portfolio.

Oak Tree Assisted Living

Acquisition Price: $4,600,000 | Equity Multiple: 2.5x / 5 Years

Closed: November 21, 2025

-

Oak Tree Assisted Living is a 50-unit (60 Bed), Class B assisted living facility (ALF) located northeast of San Antonio, in one of the fastest growing suburban markets, New Braunfels, Texas. The property remained well maintained and benefited from strong senior population growth locally and limited competing supply within the senior assisted living space, creating an immediate investment gap within senior housing.

-

At acquisition, the facility operated at approximately 70% occupancy, and 25% below market rents. The facility showed large operational inefficiencies, underutilized marketing and expense optimization, which offers significant room for value-add opportunities NOI improvement post-acquisition.

-

Hukam Capital Group has partnered with Main Street Senior Living, a best-in-class senior living operator to help execute the operational value-add strategy focused on growing occupancy, increasing quality of care, optimizing staffing, and renegotiating with vendors to stabilize and improve NOI of the property, and return capital to investors through a refinancing event

Southgate Commons

Acquisition Price: $5,000,000 | Equity Multiple: 1.62x / 3 Years

Closed: August 26, 2025

-

Southgate Gardens (Prev. Meadows Pointe), is a 77-unit multifamily community located within a well-established workforce housing market of Colorado Springs. The property presented a durable Class C asset in the market, benefiting from recent capital improvements and expenditures, including renovated units, new roofs, and solar infrastructure.

-

Due to poor property management and high vacancy on acquisition, this asset was acquired at a significant discount. Supported by tailwinds from in-migration trends, limited new Class C supply, and above-average rental growth in Colorado Springs, the property created a compelling low-risk value-add opportunity fitting our investment criteria.

-

Hukam Capital Group focused on acquiring the asset below replacement costs and comparable sales, and partnering with a local real estate operator, who bring prior expertise in multifamily operational turnaround, and an established property management network within Colorado Springs to stabilize occupancy, manage renovations, and optimize rent to drive NOI growth.

The Althea

Acquisition Price: $17,000,000 | Equity Multiple: 5.0x / 10 Years

Closed: December 26, 2024

-

The Althea is a 165-unit mixed use ground-up development located in East Orange, NJ. The development is located just one block from the Brick Church NJ Transit Station providing direct access to Manhattan in under 25 minutes. Similar large-scale developments led by Goldman Sachs & Triangle Equities are breaking ground, Crossings at Brick Church, which further reinforced this opportunity through growing institutional presence.

-

With approximately 18,000 SF of ground-floor retail, the development represented an extremely rare opportunity to get investors exposed in an institutional-quality development within a rapidly-growing corridor of New Jersey. Once developed and occupied, the property presents investors with generational cash flows through its evergreen investment structure.

-

Partnering with Saddle River Associates, a deeply experienced regional developer, Hukam Capital Group has been able to creatively structure the deal through a $52,000,000 ASPIRE Tax Credit from the NJ Development Agency to redevelop the neighborhood with a 20% affordable housing component. This credit will be sold to large institutions and turn into equity and support construction loans.